Open topic with navigation

Maintaining Percentage Rent Profiles

- The Percentage Rent Profile screen is used to set up Percentage Rent templates which will then be linked to a Sales-%Rent charge on a Lease.

Menu

| Utilities |

> |

Retail |

> |

Percentage Rent Profile |

Mandatory Prerequisites

There are no Mandatory Prerequisites related to creating a Percentage Rent Profile.

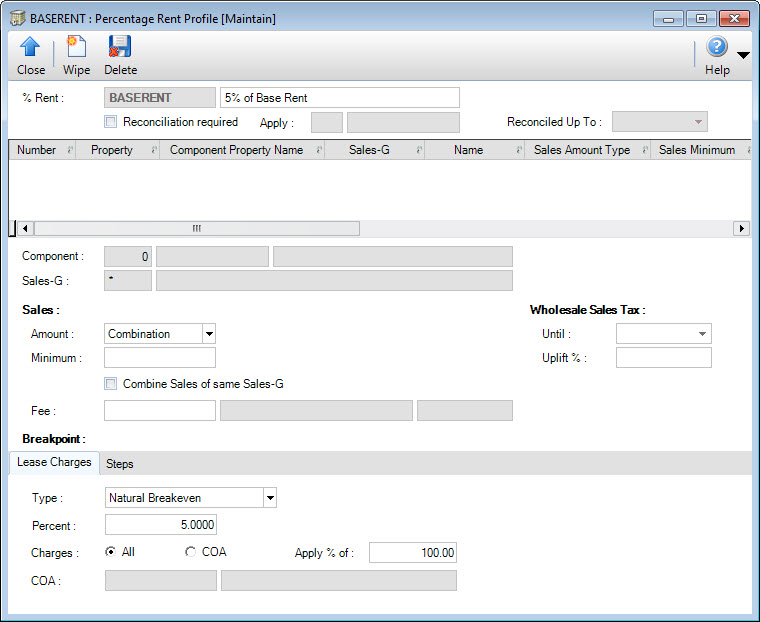

Screenshot and Field Descriptions: Percentage Rent

%Rent: this is the primary identifier for the Percentage Rent Profile.

%Rent: this is the primary identifier for the Percentage Rent Profile.

Name: this is the descriptive name of the Percentage Rent Profile.

Name: this is the descriptive name of the Percentage Rent Profile.

Reconciliation: the following optional fields relate to reconciling the % Rent amount when the Audited Sales figures are known using the Percentage Rent Reconciliation process:

Reconciliation required: this check box is to nominate if the % Rent amount needs to be reconciled.

Apply: this is the number of periods to reconcile for.

Reconciled Up To: this is the date that the % Rent amount has been reconciled up to. It will be incremented automatically when the Percentage Rent Reconciliation process is run.

When setting up the Percentage Rent Profile templates the Component Properties table, Component and Sales-G fields will be blank. These fields will only have values when attaching the Profile to the Sales-%Rent charge on the Lease screen.

Component Properties table: this provides you with a list of all the Components and their Sales Groups that are attached to the Lease.

Component: this is a read only field that displays the Component you are configuring.

Sales-G: this is a read only field that displays the Sales Group you are configuring.

Sales

Amount: this is the sales amount that the % Rent calculation will be based on. The options are Combination, Audited, Reported, Estimate, Forecast and Budget .

Select the Combination option in the Sales Amount drop down list for the % Rent calculation to use the Sales amount of the highest importance available at the time. For example, the Estimate sales amount will be used if the Reported amount has not been entered.

Minimum: this is the minimum sales amount that the % Rent calculation will be based on.

Combine Sales of same Sales-G: click this check box if sales amounts for the same Sales Group are to be added together before the % Rent breakpoints are applied.

Fee: an Administration Fee can be added on top of the % Rent calculation based on the sales amount. This could be used for a promotions levy.

Fee: an Administration Fee can be added on top of the % Rent calculation based on the sales amount. This could be used for a promotions levy.

Wholesale Sales Tax

Until: this is the date up to which the Wholesale Sales Tax will apply.

Uplift %: this is the uplift percent to add to the sales amount to account for Wholesale Sales Tax in the % Rent calculation.

Breakpoint - Lease Charges Tab

Type: this is the breakpoint type based on the lease charge amount raised over the period. The options are:

- Natural Breakeven - the sales breakpoint is calculated based on lease charges raised divided by a percent.

- Deduction - the lease charge amount is deducted after the % Rent has been calculated based on the sales amount.

- Charges By Factor - the sales breakpoint is calculated based on lease charges raised multiplied by a factor.

Percent: this is the percent to calculate the sales breakpoint when the Natural Breakeven option is selected in the Type field.

Charges: this is for selecting which chart of accounts are going to be used to work out the lease charge amount raised. The options are:

- All - sum all lease charges amounts raised.

- COA - sum the lease charge amounts raised for the selected chart of account in the COA field below.

Apply % of: this is the percentage amount of the lease charges amount raised to apply to the % Rent calculation. The default is 100%. It is displayed when the Natural Breakeven or Deduction option is selected in the Type field.

Apply Factor: this is the factor amount to apply to the lease charges amount raised for the % Rent calculation. The default is 1. It is displayed when the Charges By Factor option is selected in the Type field.

COA: this is the chart of account to select if the Charges: COA option is chosen.

COA: this is the chart of account to select if the Charges: COA option is chosen.

Breakpoint - Steps Tab

Breakpoint Steps table: this lists the sales amount breakpoints and the percent or fixed amount to apply in the % Rent calculation.

From: this is the starting point of the sales amount range. It can be left blank if required.

To: this is the end point of the sales amount range. It can be left blank if required.

Percent: this is the percent to apply to the sales amount within the entered range.

Amount: this is the fixed amount to apply. It is an alternative to applying a percent.

How Do I : Search For and Maintain Entities

These General Rules are described in the Fundamentals Manual: How Do I : Search For and Maintain Entities

How Do I : Add a new Percentage Rent Profile

- At the % Rent field, enter a new % Rent Profile ID.

- At the Name field, enter the name of the Percentage Rent Profile.

- If the % Rent amount needs to be reconciled click the Reconciliation required check box and enter the number of periods in the Apply field.

- Select the sales amount that the % Rent calculation will be based on from the Sales: Amount list box.

- In the Sales: Minimum field, if required, enter a minimum sales amount that the % Rent calculation will be based on.

- Click the Sales: Combine Sales of same Sales-G check box if sales amounts for the same Sales Group are to be added together before the % Rent breakpoints are applied.

- In the Sales: Fee field, if required, locate the Administration Fee to be added on top of the % Rent calculation based on the sales amount.

- Enter a date in the Wholesale Sales Tax: Until field if the tax still applies up until a certain date.

- Enter a percent in the Wholesale Sales Tax: Uplift % field if the sales amount needs to be adjusted for the tax.

- On the Breakpoint: Lease Charges Tab select from the options in the Type list box if a breakpoint or deduction is to be based on lease charges raised. If the Natural Breakeven option is selected, enter the percent in the Percent field that will be used to calculate the sales breakpoint.

- Select from the Charges options. If the Charges: COA option is selected, the COA field will be enabled. Locate the chart of account to be used to calculate the lease charge amount raised.

- If the Natural Breakeven or Deduction option is selected in the Type list box, change the Apply % of field if required.

- If the Charges By Factor option is selected in the Type list box, change the Apply Factor field if required.

- Click the Breakpoint: Steps Tab to set up further sales amount breakpoints.

- Enter the sales amount range in the From and To fields.

- Enter the Percent or Amount to apply for sales amounts in that breakpoint step.

- Click the Right Hand Side Application tool-bar push button: Add.

- Repeat these steps to add further breakpoint steps.

- Once you have entered all the data required, click the Application tool-bar push button: Add and confirm that you wish to add the new record.

How Do I : Modify an existing Percentage Rent Profile

- At the % Rent field, locate a % Rent Profile.

- In the Name field, enter the name of the Percentage Rent Profile.

- If the % Rent amount needs to be reconciled click the Reconciliation required check box and enter the number of periods in the Apply field.

- Select the sales amount that the % Rent calculation will be based on from the Sales: Amount list box.

- In the Sales: Minimum field, if required, enter a minimum sales amount that the % Rent calculation will be based on.

- Click the Sales: Combine Sales of same Sales-G check box if sales amounts for the same Sales Group are to be added together before the % Rent breakpoints are applied.

- In the Sales: Fee field, if required, locate the Administration Fee to be added on top of the % Rent calculation based on the sales amount.

- Enter a date in the Wholesale Sales Tax: Until field if the tax still applies up until a certain date.

- Enter a percent in the Wholesale Sales Tax: Uplift % field if the sales amount needs to be adjusted for the tax.

- On the Breakpoint: Lease Charges Tab select from the options in the Type list box if a breakpoint or deduction is to be based on lease charges raised. If the Natural Breakeven option is selected, enter the percent in the Percent field that will be used to calculate the sales breakpoint.

- Select from the Charges options. If the Charges: COA option is selected, the COA field will be enabled. Locate the chart of account to be used to calculate the lease charge amount raised.

- If the Natural Breakeven or Deduction option is selected in the Type list box, change the Apply % of field if required.

- If the Charges By Factor option is selected in the Type list box, change the Apply Factor field if required.

- Click the Breakpoint: Steps Tab to set up further sales amount breakpoints or change existing breakpoints.

- To add new breakpoint steps enter values in the From, To, Percent and Amount fields as required then click the Right Hand Side Application tool-bar push button: Add.

- To change a breakpoint step, double click the row to change in the Breakpoint Steps table. Edit the From, To, Percent and Amount fields as required, then click the Right Hand Side Application tool-bar push button: Change.

- To delete a breakpoint step, double click the row to delete in the Breakpoint Steps table, then click the Right Hand Side Application tool-bar push button: Delete.

- Repeat these steps to edit further breakpoint steps.

- Once you have entered all the data required, click the Application tool-bar push button: Change and confirm that you wish to change the record.

How Do I : Delete a Percentage Rent Profile

- At the % Rent field, locate a % Rent Profile.

- Click the Application tool-bar push button: Delete and confirm that you wish to delete the record.

Related Topics

Percentage Rent Profiles are associated with the following Topics:

%Rent: this is the primary identifier for the Percentage Rent Profile.

Name: this is the descriptive name of the Percentage Rent Profile.

Fee: an Administration Fee can be added on top of the % Rent calculation based on the sales amount. This could be used for a promotions levy.

COA: this is the chart of account to select if the Charges: COA option is chosen.